To finance your first home in Kenya, you’ll need careful planning and an understanding of your options. While the journey to homeownership can be challenging, it can also bring stability and achievement.

This guide will help you navigate the process and make the best decision for your future.

7 Practical Options to Finance your First Home

You have two options: paying with cash or using a mortgage. Since many can’t fully finance their building projects in cash, mortgages are often preferred.

1. Mortgage Loans

A mortgage loan is one of the most common ways to finance your first home.

Many banks, SACCOs, and housing finance companies in Kenya offer mortgage products designed to help first-time buyers. Here’s what you need to know:

Types of Mortgage Products

Mortgage loans in Kenya come in different packages. Some of the most common types are:

- Home Purchase Mortgages: These are loans to buy an existing house.

- Construction Loans: If you’re building your house, you can get a loan for the construction process.

- Refinance Mortgages: If you already own a home but need extra cash, refinancing your mortgage can be an option.

Key Players in Mortgage Financing

There are a few well-known institutions offering mortgage loans in Kenya:

- Banks: All commercial banks in Kenya offer mortgages. You must be an active account holder to receive the loans.

- SACCOs: These are cooperative societies that offer lower interest rates for members. Examples include Mwalimu SACCO and Kenya Police SACCO.

- Housing Finance Companies: Companies like Housing Finance Group provide specialized mortgage products.

Fixed vs. Variable Interest Rates

When you finance your first home with a mortgage, you’ll come across two main types of interest rates:

- Fixed Interest Rate: Your rate stays the same throughout the loan period. This is great for budgeting because your repayments will always remain the same.

- Variable Interest Rate: This rate changes over time. It can be cheaper initially but might go up if market rates rise.

Which is Better?

It depends on your financial situation. If you prefer stability, go for a fixed rate. If you’re okay with some risk and want the chance to pay less, a variable rate might work for you.

Mortgage Tenure and Monthly Repayments

Most mortgage loans in Kenya last 10 to 25 years. Your monthly repayment will depend on the loan amount, interest rate, and length of the mortgage.

Eligibility Criteria

To qualify for a mortgage in Kenya, you generally need to:

- Be employed or self-employed with a stable income.

- Have a good credit score.

- Provide identification documents and proof of income.

Common Mortgage Mistakes to Avoid

- Don’t overestimate how much you can afford.

- Make sure to complete the property valuation and legal due diligence.

- Pay attention to your credit score.

How to Choose the Right Lender

Look for a lender with competitive rates, good customer service, and flexible repayment options. Always compare different offers before committing.

2. SACCO Housing Loans

If you’re a member of SACCO, you may be eligible for a housing loan. These loans often come with lower interest rates and flexible terms than traditional bank loans.

Advantages of Using SACCOs for Financing

- Lower interest rates.

- Easier to access if you have a strong membership history.

- Flexible repayment periods.

How SACCO Loans Differ from Bank Loans

SACCO loans are usually less strict about credit scores and can offer more personalized repayment plans. However, the loan amounts may be smaller than you can get from a bank.

3. Rent-to-Own Schemes

Rent-to-own is not a popular option in Kenya, but it is getting traction lately. With rent-to-own, you pay rent for a property, but a portion of the rent goes toward eventually buying the property.

How It Works

- You rent the house for a set period, usually 2-5 years.

- A portion of your rent is saved up as a down payment.

- After the rental period, you can buy the house, usually with the rent contributions counted as part of your deposit.

Pros and Cons of Rent-to-Own

- Pros: You get to “test” the house before committing. You’re also building equity through your rent payments.

- Cons: Rent-to-own schemes can have higher rent rates, and there may be additional fees. Getting a refund can also be more complex if you decide not to buy.

Notable Providers in Kenya

Some developers offer rent-to-own schemes, including Cytonn and HassConsult. Look for reputable developers with clear contracts.

4. Personal Savings

If you want to rely on something other than loans, personal savings can be a great way to finance your first home. It takes time, but it’s a stress-free way to avoid debt.

Tips for Disciplined Saving

- Set up a dedicated home savings account.

- Automate your savings so a percentage of your income goes into your account monthly.

- Look for high-interest savings accounts to grow your money faster.

Best Savings Accounts and SACCOs

Many banks and SACCOs in Kenya offer special savings accounts for long-term goals like home buying.

Examples include M-Shwari and Pochi La Biashara for mobile savings or Mwalimu SACCO for cooperative savings.

Tips for Saving Faster

- Cut back on unnecessary expenses.

- Look for ways to increase your income, like starting a side hustle or having a passive income.

- Save windfalls such as bonuses or tax refunds.

5. Government and NGO Programs

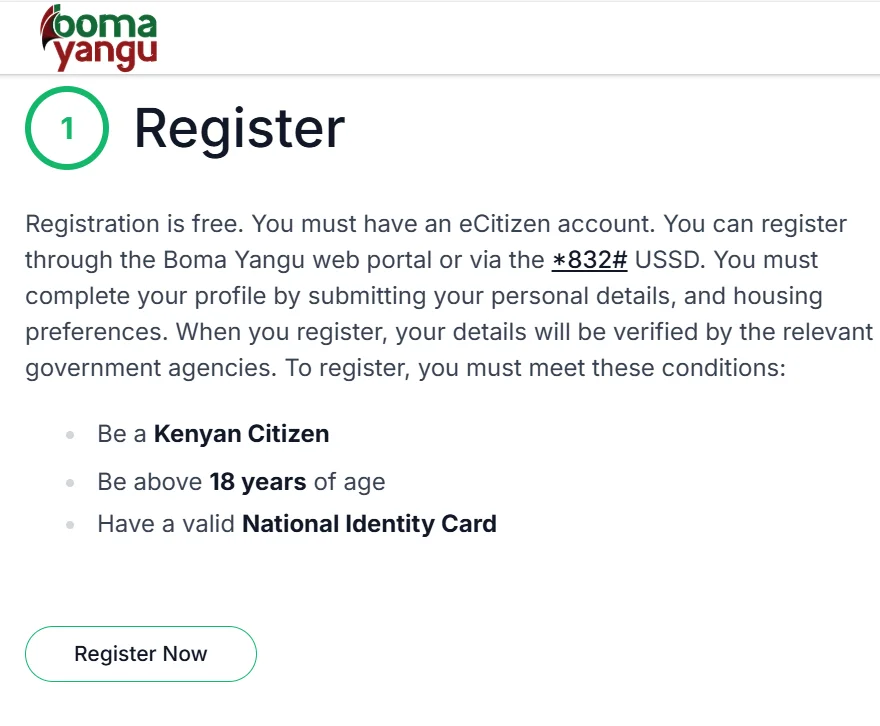

The Kenyan government has introduced several affordable housing programs to help first-time buyers. The Boma Yangu initiative, for example, allows Kenyans to register for affordable homes built by the government.

Affordable Housing Initiatives in Kenya

The government’s Big Four Agenda focuses on providing affordable housing, allowing first-time buyers to purchase homes at subsidized rates.

How to Access Government Housing Programs

- Register on the Boma Yangu platform.

- Be ready to contribute to the down payment.

- Check if you qualify based on your income and employment status.

6. Financing by Family and Friends

Some first-time homebuyers in Kenya rely on family or friends for financing. This could be through loans, gifts, or joint ownership.

How Gifting and Borrowing Work

- Gifting: Family or friends can give you money for your home purchase. No repayments are required.

- Borrowing: You can borrow money from family or friends and agree to repay it over time, usually interest-free.

Joint Home Ownership

Another option is joint home ownership, where you co-own a house with family or friends. This plan makes it easier to afford a home but comes with risks. Always make sure the agreement is clear and legally binding.

7. Seller Financing Options

Sometimes, the seller of a home can act as the lender. This means you can buy and pay for the house in installments instead of going through a bank.

This option is called seller financing and can be great if you can’t get a traditional loan.

Here’s how it works:

You and the seller agree on a price and terms. You’ll agree to pay the seller over a period, usually between 5 and 10 years.

Instead of making one big payment, you’ll make smaller monthly payments to the seller.

The interest rate is also decided between you and the seller. It can be higher or lower than what banks offer. The seller might even allow you to negotiate this.

The critical benefit of seller financing is that it’s more flexible. You don’t need to deal with a bank or SACCO.

If you cannot get a loan from a traditional lender, this can be a great way to own your dream home.

Ensure you carefully agree on the repayment terms and that everything is clear. A written agreement is very important to avoid misunderstandings down the road.

8. Chamas (Informal Investment Groups)

Chamas are an informal investment group that is popular in Kenya.

They offer a unique way to pool their resources and invest in property or other ventures.

Joining a chama can be a great option if you’re looking to finance your first home, especially if you don’t have enough savings.

How Chamas Work

The way chamas operate can vary depending on the group’s goals and structure, but here’s the basic idea:

- Monthly Contributions: Each member contributes a fixed amount to the group’s pool every month. The amount can vary, but it’s usually something everyone can afford.

- Collective Investment: The funds collected are used to purchase property, build homes, or invest in other projects. The group can buy and develop land or even purchase existing properties.

- Shared Profits or Ownership: Once the property is developed or sold, the profits are shared according to the agreed-upon terms. In some cases, members may own equal shares in the property, while in others, gains from the sale are distributed based on each member’s contribution.

Whether or not a chama can fully finance your home depends on the group and your financial goals.

Typically, a chama might not provide the entire amount needed to purchase a house, especially if you’re looking for a high-value property. However, it can serve as a valuable supplementary source of financing.

How to Make the Most of a Chama

- Understand the Terms: Every chama has its own rules, so make sure you understand how contributions, profits, and ownership are handled.

- Stay Committed: Consistent contributions are essential. If everyone in the group sticks to their commitment, your collective savings will grow faster, and the group can make more significant investments.

- Consider Other Sources of Funding: While a chama can be an excellent source of funding, you might still need to top up with your savings, a SACCO loan, or even a mortgage to finance your home entirely.

How to Assess your Financial Readiness

Assessing your financial readiness is essential before deciding how to finance your first home.

Key Considerations

- Savings: How much have you saved for a down payment? Typically, a down payment is 10-20% of the property value.

- Income Stability: Do you have a reliable income supporting monthly mortgage payments or other financing options?

- Debt-to-Income Ratio: Make sure you can comfortably manage debt repayments alongside home financing.

- Credit Score: Your credit score will affect your ability to secure a mortgage and the interest rate you receive.

Set a Budget for your First Home

Setting a budget is crucial when buying your first home. Keep these factors in mind:

- Cost of Property: Consider location, size, and type of property. Properties in urban areas tend to be more expensive than those in rural areas.

- Additional Costs: Remember legal fees, stamp duty, maintenance, and insurance.

Balancing affordability with long-term investment is critical to making a wise decision.

Common Mistakes to Avoid when Financing your Home

- Overestimating What You Can Afford: Be realistic about your income and other financial obligations.

- Ignoring Hidden Costs: Ensure you account for costs beyond the initial purchase price.

- Skipping Property Due Diligence: Always verify ownership and check for legal issues.

- Relying Too Much on Debt: Create a clear repayment plan to avoid financial stress.

Success Stories of First-Time Homeowners

Mary Wanjiru: A Journey of Saving and Smart Planning

Mary Wanjiru, a teacher from Nairobi, saved diligently for 5 years to buy her first home.

She regularly contributed to SACCO and cut unnecessary costs, like dining out and subscriptions, to boost her savings.

After five years of focused saving, she could put down a 20% deposit and purchase a home in Kasarani, Nairobi.

Mary’s story shows that homeownership is possible with consistent saving, discipline, and leveraging government support.

Peter and Caroline: Building Together Through SACCO Savings

Peter and Caroline, a young couple from Kisumu, joined a SACCO to save for a home. After just two years of regular contributions, they could access a loan that helped them buy a 3-bedroom house in their hometown.

Their story demonstrates how being part of a SACCO can fast-track homeownership by providing access to affordable loans with lower interest rates.

James and His Chama: Pooling Resources for a Home

James and a group of friends started a Chama to invest in property. After three years of contributing to the group fund, they used the money to buy land. James was able to use his share of the land to build his dream home.

Collaborating with others in a chama can make property investment easier and faster, especially when resources are limited.

Lessons Learned:

- Plan and have the right approach

- Stay committed.

- Make sure you understand all the terms of your financing option.

Final Word

Financing your first home in Kenya is a big step, but it’s possible with the proper planning. Explore your options, stay disciplined with your finances, and don’t be afraid to seek help. Homeownership is within your reach.