Buying a home is one of the biggest financial decisions you’ll ever make, and getting pre-approved for a mortgage is a crucial first step in the process. Mortgage pre-approval not only helps you understand how much you can afford but also strengthens your position as a serious buyer.

This guide will walk you through the pre-approval process, why it’s important, and how to increase your chances of getting approved.

What Is Mortgage Pre-Approval?

Mortgage pre-approval is a process in which a lender evaluates your financial situation and determines the maximum loan amount they are willing to offer you.

This involves a thorough review of your credit score, income, debts, and assets.

Once pre-approved, you’ll receive a pre-approval letter that can be used to demonstrate your financial credibility to sellers and real estate agents.

Why Mortgage Pre-Approval Matters

1. Helps You Determine Your Budget

A pre-approval gives you a clear understanding of how much you can afford, preventing you from wasting time looking at homes outside your price range.

2. Makes You a More Competitive Buyer

Sellers prefer buyers who are pre-approved because it shows financial readiness. In a competitive market, having a pre-approval letter can give you an advantage over other buyers.

3. Speeds Up the Homebuying Process

Since the lender has already assessed your finances, the final approval process is quicker once you make an offer on a home.

4. Helps You Identify Potential Financial Issues Early

If there are any issues with your credit score, income verification, or debt-to-income ratio, you can address them before seriously house hunting.

Steps to Get Pre-Approved for a Mortgage

1. Check Your Credit Score

Your credit score plays a major role in your mortgage approval. Most lenders require a minimum score of around 620 for conventional loans, though higher scores can secure better interest rates.

How to Improve Your Credit Score:

- Pay off outstanding debts and avoid late payments.

- Keep credit card balances low.

- Avoid opening new lines of credit before applying for a mortgage.

2. Gather Your Financial Documents

Lenders will require documentation to assess your financial health. Be prepared to provide:

- Proof of income (pay stubs, tax returns, W-2 forms, or 1099s for self-employed individuals)

- Bank statements (typically for the last two to three months)

- Credit report and debt statements

- Employment verification

- Identification (driver’s license or passport)

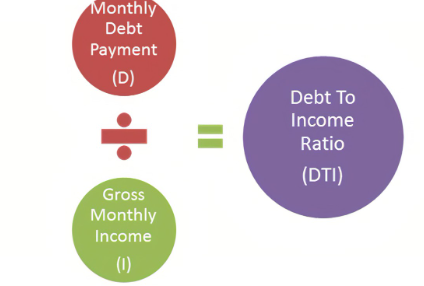

3. Calculate Your Debt-to-Income (DTI) Ratio

Your DTI ratio compares your total monthly debt payments to your gross monthly income. Lenders generally prefer a DTI below 43%, though lower is better.

How to Lower Your DTI:

- Pay down high-interest debts before applying.

- Avoid taking on new debt.

4. Research and Compare Lenders

Different lenders offer different mortgage products, interest rates, and fees. Shop around and compare loan terms to find the best deal. Consider:

- Interest rates

- Loan terms (fixed vs. adjustable rates)

- Closing costs and fees

- Customer service reputation

5. Submit Your Pre-Approval Application

Once you’ve chosen a lender, submit your pre-approval application along with the required documents. The lender will review your financial history, run a credit check, and determine how much you qualify for.

6. Receive Your Pre-Approval Letter

If approved, the lender will issue a pre-approval letter stating the maximum loan amount. This letter is typically valid for 60-90 days.

What to Do After Getting Pre-Approved

Stick to Your Budget

Just because you’re pre-approved for a certain amount doesn’t mean you should spend the full amount. Consider additional costs like property taxes, homeowners insurance, and maintenance expenses.

Avoid Major Financial Changes

Do not make large purchases, open new credit accounts, or change jobs after getting pre-approved. Lenders may re-evaluate your financial situation before finalizing the loan.

Start House Hunting

With your pre-approval in hand, work with a real estate agent to find homes within your budget. Having a pre-approval allows you to move quickly when you find the right home.

Keep Your Financial Documents Updated

Lenders may request updated documents before final loan approval. Continue saving bank statements and pay stubs to avoid any delays.

Conclusion

Getting pre-approved for a mortgage is an essential step in the homebuying process. It helps you understand your budget, strengthens your position as a buyer, and ensures a smoother transaction.

By checking your credit score, gathering financial documents, and working with reputable lenders, you can increase your chances of securing the best mortgage terms.

Taking these proactive steps will put you on the path to successful homeownership.