As Nairobi’s population grows and urbanization accelerates, real estate has become one of the most lucrative investment opportunities in Kenya.

For rental property investors, one of the first and most important decisions is choosing the right type of property to invest in—bungalows, maisonettes, or apartments. Each comes with unique features, returns, tenant demand, and risks.

This guide takes a deep dive into the pros and cons of each property type, pricing trends, target tenants, maintenance implications, and rental yields—equipping you with the insight you need to make a well-informed investment decision.

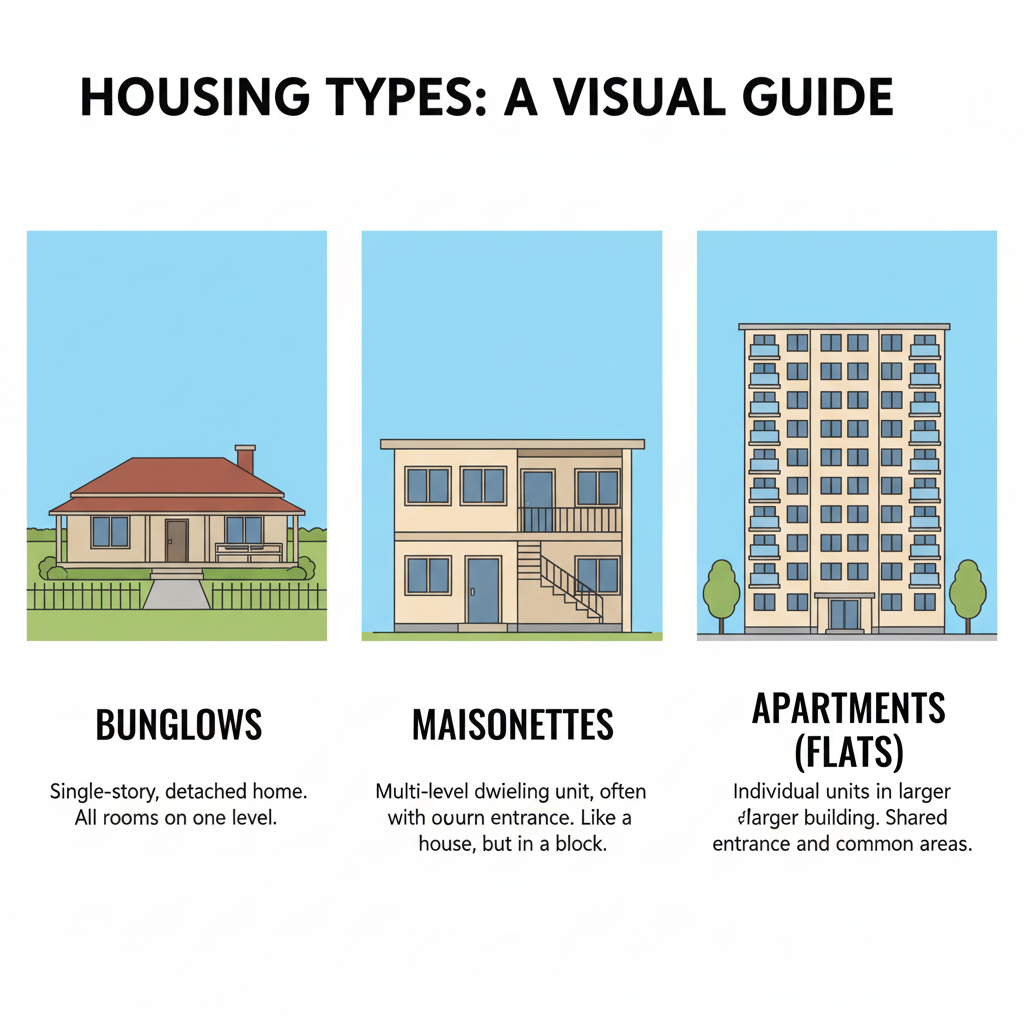

1. Understanding the Property Types

Before diving into market dynamics, let’s define the three property types:

- Bungalows are single-storey standalone houses. They usually sit on their own plots and offer privacy, garden space, and easy access for families or the elderly.

- Maisonettes are double-storey homes—often semi-detached or standalone. They typically have living spaces downstairs and bedrooms upstairs, offering more room without increasing the footprint.

- Apartments (Flats) are multi-unit housing blocks with several units on multiple levels, often with shared amenities like parking, staircases, or lifts.

2. Investment Cost Comparison

| Property Type | Average Cost (Ksh) in Nairobi (2025 Estimate) | Land Requirement | Construction Cost |

|---|---|---|---|

| Bungalow | 6M – 12M (depending on location & size) | High | Moderate–High |

| Maisonette | 11M – 25M | Medium–High | High |

| Apartment | 5M – 25M (per unit) | Low | Scalable |

- Apartments offer the lowest entry barrier, especially when buying off-plan or in mid-rise developments.

- Maisonettes and bungalows require land, making them more capital-intensive upfront.

3. Rental Yield Analysis

Rental yield is a key performance metric for investors. Here’s a typical yield comparison based on Nairobi averages:

| Property Type | Average Monthly Rent | Typical Locations | Average Rental Yield |

|---|---|---|---|

| Bungalow | Ksh 30,000 – 80,000 | Ongata Rongai, Syokimau, Ruiru, Kikuyu, Ngong, Kitengela | 5% – 7% |

| Maisonette | Ksh 40,000 – 120,000 | South C, Kitengela, Utawala, Ongata Rongai, Syokimau, Ruiru, Ngong, Kiserian | 6% – 8% |

| Apartment | Ksh 15,000 – 60,000 | Roysambu, Embakasi, Kahawa West | 7% – 10% |

- Apartments offer higher yields due to lower cost per unit and high demand in urban centers.

- Maisonettes perform best in middle-class estates.

- Bungalows attract steady tenants but have a slower ROI due to higher land costs.

4. Target Tenant Segments

Each property type serves a distinct demographic:

- Bungalows: Families, retirees, and long-term tenants seeking privacy and space. Ideal for tenants with cars, pets, or elderly members.

- Maisonettes: Upper-middle-income families, professionals, and diplomats. Suited for secure estates with compound space and parking.

- Apartments: Young professionals, students, small families, and single tenants. High tenant turnover but consistent demand.

5. Location and Land Use Considerations

- Bungalows and maisonettes perform well in satellite towns and gated suburbs like Kitengela, Ruiru, Syokimau, Rongai, Ngong, and Kiambu.

- Apartments thrive in densely populated areas such as the Thika Road corridor, Westlands, Ruaka, Githurai, and Donholm, where high-rise zoning is permitted.

- Land prices are a key consideration: High land costs in central Nairobi make maisonettes and bungalows less viable within CBD-adjacent neighborhoods, while they flourish further out where land is still affordable.

6. Maintenance and Operational Considerations

| Aspect | Bungalow | Maisonette | Apartment |

|---|---|---|---|

| Repairs | Individual owner | Individual owner | Shared (if gated) |

| Security | Must be provided | Often shared/gated | Often provided |

| Utilities | Fully private | Shared/Gated | Often metered |

| Resale Value | Moderate | High | Depends on age |

- Apartments in high-rise blocks can become harder to maintain as they age, leading to depreciation.

- Maisonettes in gated communities often retain high value due to uniform planning and shared services.

- Bungalows offer freedom but require more active management.

7. Appreciation vs. Cash Flow

Investors must decide whether to prioritize appreciation or cash flow:

- Bungalows and Maisonettes: Higher capital appreciation over time, especially in growing satellite towns.

- Apartments: Generate better cash flow due to affordability and turnover, but may depreciate faster without proper management.

8. Emerging Market Trends

- Demand for 3-bedroom apartments is rising due to urban densification and smaller families.

- Gated communities of maisonettes (e.g., in Kitengela, Kikuyu, and Ruiru) attract tenants seeking security and space.

- Affordable bungalows in outer zones like Kamangu, Gikambura, and Joska are seeing increased demand from families seeking rental homes with a compound.

- Investors are shifting to mixed-use developments and studio apartments near commercial hubs for short-stay rental income.

9. Pros and Cons Summary Table

| Type | Pros | Cons |

|---|---|---|

| Bungalow | Privacy, space, good for long-term tenants | High land cost, low density, slow ROI |

| Maisonette | High resale, spacious, suits families, secure estates | High cost, limited in high-density zones |

| Apartment | Affordable, high rental yield, high demand | Less privacy, high turnover, management issues |

10. Recommendations Based on Investment Goals

- Looking for high rental income fast?

➤ Go for apartments in high-density areas like Roysambu, Donholm, or Githurai. - Looking for long-term value and appreciation?

➤ Consider maisonettes in upcoming suburbs like Ruiru, Kikuyu, or Ngong. - Looking for steady tenants and space?

➤ Bungalows in Ongata Rongai, Syokimau, or Kamangu offer stability.

Conclusion

There’s no one-size-fits-all when it comes to investing in Nairobi’s rental property market. Your ideal choice—bungalow, maisonette, or apartment—depends on your budget, goals, and risk appetite.

While apartments deliver higher short-term yields, maisonettes and bungalows offer long-term growth and value. Understanding the dynamics of tenant preferences, location, and cost will help you make a profitable decision.

Tip: Always factor in estate management, future infrastructure, and local rental demand before buying.